Introduction

Over the last year or so, I have noticed increasingly we are being asked to review whole system CRM and ERP requirements. I find that clients are now looking for a totally integrated and streamlined system or future system. So why is this?

Reflecting on the many changes over the last few years, I think there have been three key drivers at work here:

- Emergence of Cloud into mainstream

- Platform approach

- Growth in Vendor eco-systems

Let’s examine each of these key drivers?

1. Emergence of Cloud into mainstream

It is now rare indeed where we came across a mid-sized organisation looking to stay on their legacy on-premise system, be this CRM or ERP. Most IT departments I talk to are now pushing for cloud-based solutions and without going into the well-trodden path of comparing cloud versus on-premise benefits, the main factors for this in my view are:-

- Cloud is now mainstream. The last five years have seen a dramatic change in attitude, 10 years ago, we had the innovators, now most IT Directors are looking at what I like to call a cloud-first policy for new apps. A Bitglass 2018 analysis of more than 135,000 organisations showed cloud adoption had topped 81 percent – a 37% increase since 2016 and an incredible 238% increase since 2014!

- Office 365 has been another key business factor here in making cloud mainstream, so Microsoft has done an excellent job. Some figures suggest over half of organisations have now deployed Office 365. After all, once your email is cloud-hosted, seen as your Users most sensitive app in daily use, where next?

- Cloud access and security concerns allayed. Vendors have spent large amounts building specific Trust websites, take just two examples: Salesforce and Microsoft.

- Up-time Availability. With 99+% service levels available, this again supports this cloud-first transition and increases business and user confidence. Again, what internal IT department would be able to afford to offer 99+% availability, let alone guarantee this all year round on their own servers!

- Subscription or pay as you go model widely accepted. For many, this is now their preferred pricing model. Clients are able to better budget and with a cloud app, the iceberg analogy applies but in reverse, where most of the costs are all highly visible, there are no ‘hidden costs’ such as unexpected server replacement, maintenance, and services upgrades.

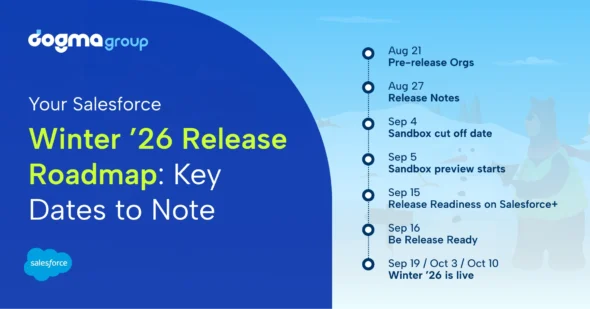

- Always up-to-date. Regular upgrades are built into the subscription. This enables Microsoft to have 2 upgrades per year and Salesforce 3 per year, whilst SAP Hana has one major update per year. This is replicated across the vendors, removing or reducing another IT headache.

- Inter-connectivity. Linking between cloud apps is one of the secrets to the success for the rapid rise in the cloud deployment. All of a sudden, the big expensive integration problem can become a lot smaller and more manageable with other cloud-based apps.

2. Platform approach

The CRM and ERP vendors have spent many millions of dollars in moving their offering to the cloud, so that today, all major mid-market vendors have a platform offering, be this Oracle, SAGE, SAP, and Microsoft whilst Salesforce has always been cloud-based since 1999. In fact, I would argue you would be hard pushed nowadays to find any major on-premise new application launches in the last 5 years in the Western World where we have an advanced IT infrastructure and ever-improving broadband speeds.

There has been this massive investment by the likes of Salesforce and by Microsoft since 2014 on creating platform suites. This is repeated across the Software vendors.

But, first, what do we mean by a Platform. Well for me, Technopedia.com explanation sums this up very neatly: “a platform is a group of technologies that are used as a base upon which other applications, processes or technologies are developed”

Taking two examples I know well, Salesforce have their Lightning platform, upon which vertical industry solutions have been built, including for example, Veeva, a primarily life sciences application, whilst Microsoft’s Azure and Dynamics 365 platform using the common data model is becoming widely used as a foundation across industries, here, for instance, Peppermint, a legal solution, has been built on Dynamics 365 and SharePoint and has been very successful in its target market.

This platform approach has been widely adopted by other leading software brands such as Oracle Cloud platform and SAP with its SAP HANA platform.

A key business driver is the need for a single shared view of the customer, currently not as easy as it sounds with older legacy on-premise systems. Indeed, a recent survey from Salesforce in their State of IT survey from 2017 highlighted this as key objective. This problem for many IT Directors is still being hindered by having multiple legacy applications that are hard to integrate. By adopting a Platform approach this can be a major factor in starting to resolve and reduce this issue over the long term.

3. Growth in Vendor Eco-systems

The third key driver in recent years which I think has been instrumental has been the tremendous growth of integrated vendor supported and promoted eco-systems. All the major players have been actively encouraging and supporting third-party companies to produce add-on’s or build vertical solutions on their own market place to augment their core offering and fulfill functional niches. Taking four examples, firstly Salesforce AppExchange, launched its own marketplace for third-party applications way back in 2006 and now has over 3500 apps available that interconnect and which are all downloadable from their marketplace for any client.

Similarly, Microsoft has its own marketplace for third-party apps, called AppSource, whilst Oracle has Oracle Cloud Markeplace and SAP its own SAP App centre. Indeed, such is the importance of this new market for apps, Forrester, the industry analysts, are now measuring these marketplaces in a new Forrester Wave annual review.

The strength of these online marketplaces for the vendor’s platform is in being able to offer their clients tried and test tactical solutions to missing functional or process needs and supporting their core product offering. Of course, added to this, the major add-on niche application players such as e-mail marketing, e-documentation, and marketing automation strive to have their own inter-connectivity app on these marketplaces to maximise their own market opportunity and support their own offering.

Final thoughts

Today, the major providers are able to offer the complete CRM-ERP solution with their platform integrated with a marketplace eco-system of third-party apps. And to illustrate this, taking one example from Microsoft the Dynamics 365 for mid-sized organisations has over last few years expanded to now offer a complete Lead-to-Cash suite of core applications, so, for example, this could include:

- Dynamics 365 Marketing: capturing visitors to your website and converting them into Leads

- Dynamics 365 Sales: Supporting engagement in the Lead to Opportunity process and creating quotations and orders, which will then be processed through

- Dynamics 365 Business Central: Financial transactions, invoicing and shipping through this core ERP system (previously known as the well-respected Navision product)

And then any other niche functional gaps such as e-documentation, for example, can be fulfilled with a choice of approved apps from their online marketplace, Appsoruce

The key point is in this example is there is: One Vendor, One Platform, One Eco-system which is now able to support this whole end to end Lead-to-Cash process in the cloud at an affordable price and without the endless integration issues of previous on-premise software.

As I stated at the start of this post, suffice to say, more and more clients are taking less of a tactical approach and are now considering first their overall CRM and ERP requirements and are recognising the remarkable transition of the last few years in being able to move to a single Platform. Clients are now looking at their plans much more holistically in a way that was probably not feasible or possible even just 5 or 6 years ago.

The myth of a single platform approach even just 5 years ago is now rapidly turning into a reality across the whole IT sector. You can argue if this is 100% complete for all the brands mentioned, but the direction of travel is clear and certainly, in the next 5 years, they will be no more myth just the reality of an ever converged single CRM–ERP platform solution being an achievable goal.

Published by Gary Perkins, Business Development Manager at SeeLogic